Trustees taking on liabilities of the trust

February 24, 2026

When someone acts as a trustee of a family trust, they often take on liabilities associated with the trust. Those liabilities generally include obligations to the trust’s lender (such as a bank) or other creditors.

READ MORETaxing the business income of charities

February 24, 2026

In February 2025, Inland Revenue issued a paper entitled ‘Taxation and the not-for-profit sector’ (the Issues Paper). Among other things, the Issues Paper proposed taxing the business income of charities, where that income did not relate to their charitable purposes. This was highly controversial and resulted in a flurry of submissions.

READ MORENew Zealand’s Resource Management Act overhaul

January 23, 2026

For more than three decades, the Resource Management Act 1991 (RMA) has shaped how New Zealand uses land, builds homes and infrastructure, and protects its natural environment. It has been one of the country’s most influential, and controversial, pieces of legislation.

READ MOREMoo-ving on

December 10, 2025

In August, Fonterra announced that it had agreed to sell its major consumer brands. The sale will see Lactalis take ownership of iconic New Zealand brands such as Anchor and Mainland; it comes as part of Fonterra’s strategy to pursue an increased emphasis on its ingredients and foodservice businesses.

READ MORENew Zealand’s methane reset

December 10, 2025

In October 2025, the government confirmed it will reset New Zealand’s biogenic methane target for 2050; it will move from the legislated 24–47% below 2017 levels, to a 14–24% range, while keeping the 10% cut by 2030 and the net-zero target for long-lived gases.

READ MOREDigital assets and your estate

November 20, 2025

For many New Zealanders, daily life is now as much online as it is offline. From internet banking and investment platforms to email accounts, social media, cloud storage and cryptocurrencies, our ‘digital footprint’ has become an important part of who we are and what we own.

READ MOREUsing AI in your business

November 20, 2025

Artificial intelligence (AI) has developed from a futuristic concept to a mainstream tool used by many businesses on a daily basis. The exponential growth of AI in recent months/years is hard to miss, with various industries adopting the technology to streamline operations and boost productivity.

READ MOREVendor Supplied Reports/ Disclosures

November 3, 2025

The general rule of thumb when you buy a property is that the more information you can find out about the property, the better. Sometimes, the information you are interested in will be offered by the seller or their real estate agent. Can you rely as much on information obtained from these parties as you could using a third party? And how does the information provided by the seller or their agent affect your rights under the contract for sale and purchase?

READ MORERent Reviews in Commercial Leases

November 3, 2025

Two of the most important considerations for parties to a commercial lease are, ‘What is the annual rent?’ and ‘How and when can the rental amount be reviewed?’ The answers are always found in the deed of lease for the premises.

READ MOREEnduring Power of Attorney

September 10, 2025

If your family member is losing capacity and has an Enduring Power of Attorney (EPA) in place, you will be reassured that their attorney is working in your loved one’s best interests. Very occasionally, however, this isn’t the case. In this article, we look at how an EPA works and what can be done if you believe the attorney is not doing their job properly.

READ MOREThe office of executor: does it ever end?

September 10, 2025

An executor is named in a will as the person the will-maker appoints to administer their estate after their death and to carry out the terms of their will.

READ MOREThe Ombudsman

September 9, 2025

Have you ever felt as though you’ve tried every avenue to resolve a battle with bureaucracy and got nowhere? The Office of the Ombudsman is an option you could consider.

READ MOREEmployment law reform in 2025

September 9, 2025

Employment law continues to evolve, with several changes, or proposed changes, introduced by the government in recent months. The changes are widespread across the employment law spectrum, and it will be important for both employers and employees to be across them.

READ MORECredit Contracts and Consumer Finance Amendment Bill

May 26, 2025

On 31 March 2025, the government introduced into Parliament a reform package making major changes to New Zealand’s financial services landscape. Included in the reform package is the Credit Contracts and Consumer Finance Amendment Bill which proposes to reform the regulation of credit markets to make them fairer, more efficient and transparent.

READ MOREBudget 2025

May 26, 2025

On 22 May, the Minister of Finance, the Hon Nicola Willis, presented what she had termed a ‘No BS Budget.’ It is officially entitled ‘The Growth Budget.’ Described by the minister as being ‘fiscally conservative,’ public expectations were not high for a lolly scramble of funding for new initiatives.

READ MOREFirearms reform 2025

April 30, 2025

The government is currently undertaking a comprehensive reform of our firearms laws; it aims to modernise the Arms Act 1983 which it considers to be outdated and overly complicated. The overhaul is the fourth phase of a commitment to reform the firearms regulatory system following on from three previous phases implemented after the 2019 Christchurch mosque shooting.

READ MOREEmissions Trading Scheme

April 30, 2025

The Emissions Trading Scheme (ETS) will turn 17 years old in September. An integral part of the Climate Change Response (Emissions Trading) Amendment Act 2008, the ETS has undergone significant change throughout its existence.

READ MOREArrested?

April 4, 2025

There is a fair legal process Many people are guilty of spending too much time in front of screens watching crime shows. There is certainly no shortage of police dramas on television.

READ MOREFast Track Approvals Act 2024

April 4, 2025

The legislation is part of the coalition agreement between National and New Zealand First. The government’s stated purpose for the Fast Track Approvals Act is to make it quicker and easier to build the projects New Zealand needs to grow its economy. It aims to cut through the “thicket of red and green tape” and approvals processes that the government believes has held New Zealand back from much needed economic growth. It is intended to create a ‘one stop shop’ consenting process for gaining approvals…

READ MOREIssues affecting finance and settlement

March 25, 2025

When you have lending secured by a mortgage on your home, it will be a condition of that lending that you have full replacement insurance for your house. This is a requirement for any new lending (and your lender won’t allow you to draw down the loan without seeing evidence that this in place), and an ongoing requirement with existing lending.

READ MORENew deed of lease documentation

March 25, 2025

In November 2024, The Law Association of New Zealand (TLANZ), formerly the Auckland District Law Society, released an updated version of the standard form deed of lease document, its 7th edition.

READ MOREOverturning the foreshore and seabed decision

December 28, 2024

The government proposes to overturn a 2023 Court of Appeal decision covering Māori customary rights to the foreshore and seabed. It is of the view that the court’s decision gives too much power to iwi and hapū over what happens on ‘too much’ of New Zealand’s coastal areas.

READ MOREThe moral dilemma of virtual fencing

December 28, 2024

The popularity of virtual fencing is increasing quickly amongst dairy farmers, as an efficient method to contain and move stock. The technology works through a collar around, say, a cow’s neck that moves it by sounds and guides it from left to right. If the cow steps over the virtual boundary, it is first guided back by sound and, if that cue is ignored, it is given a low energy shock (significantly weaker than an electric fence). It is also capable of guiding cows to walk themselves to the milking…

READ MOREHiring casual employees

November 21, 2024

With summer shortly upon us, the up take in casual work is synonymous with school and university holidays. Despite the short-term nature of these roles, whether it’s seasonal fruit-picking, a retail Christmas-casual or a restaurant needing extra cover for busy nights, if you hire staff on a casual basis you still have significant legal responsibilities.

READ MOREWhy should I look at my will?

November 21, 2024

You should review and update your will regularly. It is not something that, once done, you should just stick in a drawer and forget about. There are many significant milestones in life when you should think about whether your will is still appropriate for your unique circumstances.

READ MOREThe plight of stepchildren

August 22, 2024

When a parent dies and leaves their child or children out of their will, those children are entitled to bring a claim against their parent’s estate under the Family Protection Act 1955 (FPA). While a financially stable adult child may not have a claim to a large proportion of their parent’s estate, they will usually still have a claim for ‘recognition.’

READ MOREContracting out agreements for relationships late in life

August 22, 2024

You may think that a ‘pre nup’ is most commonly used when a young couple begins a relationship and there is a significant difference in their financial position. However, these agreements, formally known as contracting out agreements (COAs), can be entered into at any time during a relationship. They are particularly useful for couples entering into a de facto relationship, or marrying later in life, as both parties are more likely to come to the relationship with more complex financial affairs.

READ MOREThe Future of Indoor Pig Farming

July 29, 2024

Concern has been expressed by industry body, New Zealand Pork (NZP), that the National Policy Statement for Highly Productive Land (NPS-HPL) is threatening the future viability of indoor pig farms. It believes the NPS-HPL is preventing current indoor farms from increasing in size and is blocking new indoor farms from being established on productive land.

READ MOREBudget 2024

July 29, 2024

On 30 May 2024, the Minister of Finance, Nicola Willis, presented her first Budget. The government is focussed on rebuilding the economy, easing the cost of living, delivering better health and education services, and restoring law and order.

READ MOREProviding for your family in your will

July 15, 2024

We all want to look after our families – both during our lives and after we die. One way you can make sure that your family is looked after when you die is by leaving behind a clear, well-drafted will.

READ MOREPreparing your business for sale

July 15, 2024

Whether you’re retiring, pursuing new ventures or looking to cash in on your hard work, selling a business is a significant milestone and one that needs careful planning and preparation. To ensure the greatest return on your investment, your business should be at its best when it goes on sale. Building value in your business is important in attaining an optimum result.

READ MORECan losses be recovered from a faulty building?

June 11, 2024

The High Court recently found that the construction and insurance sectors can rely upon limited liability clauses when defending claims for negligence or breach of contract in commercial projects.

READ MOREThe Budget 2024

June 11, 2024

Although it is clear the economic outlook is somewhat gloomy, in delivering the 2024 Budget, the Minister of Finance, Nicola Willis, said that savings across government have resulted in responsibly-funded tax relief. “Spending is targeted, effective and affordable.”

READ MORELive Animal Exports

May 9, 2024

In April 2023, following intense pressure from animal welfare organisations, the Labour government banned live animal exports. The basis of the ban was centred on an independent review that New Zealand’s international reputation was being damaged by its live animal export programme because of animal welfare standards being breached.

READ MORESignificant Natural Areas

May 9, 2024

Associate Minister for the Environment, Andrew Hoggard, announced on 14 March 2024 that the government will suspend the Significant Natural Areas (SNAs) requirements while it overhauls the Resource Management Act 1991 (RMA). It comes as a timely announcement after the Greater Wellington Regional Council’s (GWRC) unsuccessful prosecutions of two rural landowners due to the council having wrongly identified wetlands on private farmland.

READ MOREPersonal Grievances

April 3, 2024

In today’s ever-changing employment landscape, employers face a myriad of challenges. A single misstep can lead to (amongst other things) personal grievance claims, a fractured workplace culture and tainted reputations. Understanding the risk of making a blunder is essential.

READ MOREInvoices not being paid on time?

April 3, 2024

The continued rise of input costs, finance costs, labour shortages, ongoing material shortages and compliance costs are forcing many businesses to tighten their belts. In this article we give some advice to assist both creditors and debtors with managing their business relationships and financial accounts when it comes to unpaid invoices.

READ MOREEasements

March 19, 2024

An easement is an instrument registered on the title to your property that allows another party, usually your neighbour, to use the part of your property specified in the easement. In this article we explain the types of easements, their maintenance and repair, and your obligations, and what can happen if there are issues around costs and who pays.

READ MORECommercial Leasing and Landlord Consent

March 19, 2024

If you are a landlord owning commercial property, you may want to know how your tenant can make changes to the premises, or its use of the premises, without speaking to you about it first. If you are a tenant, you may want to know what you can do without being in contact with your landlord.

READ MOREEstates and Guarantees

March 6, 2024

Guarantees entered into by a person during their lifetime can create some difficult legal issues for their executor after they die.

READ MOREMaking a bequest to a charity

March 6, 2024

For many charities, gifts in wills (bequests) are a significant source of funding. Sometimes, however, charitable bequests cannot take effect when wills are not carefully drafted. There can be considerable time and cost associated with addressing that situation and trying to ensure the bequest can go to the charity you intended. This article looks at ways your wishes for a charitable bequest have the best prospect of being fulfilled.

READ MOREWhakaari/ White Island Eruption

February 7, 2024

The eruption of Whakaari/White Island on 9 December 2019 was a tragedy. Of the 47 people on the island when it erupted, 22 people were killed. The other 25 people were severely injured, many with life-changing injuries. The last of the prosecutions brought by WorkSafe due to the eruption concluded on 31 October 2023. We look at the lessons landowners and company directors can learn from these prosecutions.

READ MORETrial Periods vs Probation Periods

February 7, 2024

Many New Zealand business owners know they can offer a trial period (usually 90 days) when hiring a new employee. A trial period is designed to ensure a new employee is a good fit for their employer.

READ MOREThree Waters and Resource Management Act 1991 Replacement Legislation

December 13, 2023

The 2023 election has resulted in a National Party-led coalition, that campaigned on a commitment to repeal the Labour government’s Three Waters legislation and the Resource Management Act 1991 (RMA) replacement legislation. It has confirmed that these statutes will be repealed within its first 100 days in office.

READ MORENational, ACT, and New Zealand First Coalition

December 13, 2023

All three political parties that make up the governing coalition campaigned on the premise that agriculture is the backbone of New Zealand’s economy. Each party stated that the rural sector should be supported, rather than what they saw as being hindered by government, particularly in the areas of regulation, red tape and climate policy.

READ MOREWhat happens to your children when you separate?

November 22, 2023

Goodwill and good process will help prevent turmoil

READ MORETwo Decades on: Proposed Changes to the Retirement Villages Act 2003

November 22, 2023

You, or someone you know, may be considering a move into a retirement village. It is a big decision, involving lifestyle choices as well as a significant financial commitment. Understanding the rules that govern retirement villages is crucial – and those rules are set to change.

READ MOREAlternative Methods to sell your property

November 2, 2023

We are starting to see more upward movement in the property market which is positive news for property sellers. A more buoyant market means that sellers and their real estate agents will be looking at alternative ways to secure a buyer. Rather than sticking to traditional sales methods – advertised price, deadline sale or by negotiation – sellers may want to consider a closed tender or auction process.

READ MOREWhat happens of your builder goes bust?

November 2, 2023

Building a new home is an exciting process. It can, however, be quite daunting with risks of unexpected delays, cost increases and, in the worst scenario, your project going completely off the rails. In this article, we discuss how choosing your builder carefully can help to give you some peace of mind as you embark on your build.

READ MORENew retention monies legislation gives better protection

September 14, 2023

The Construction Contracts (Retention Money) Amendment Act 2023 was passed on 5 April this year with the legislation coming into effect on Thursday, 5 October 2023. If your business retains funds as part of a construction contract, or a contractor retains funds from you, you should ensure you are familiar with these upcoming changes.

READ MOREMainzeal Decision

September 14, 2023

Taking on the responsibility of a directorship is not a decision to be taken lightly. For New Zealand directors, the magnitude of the director role has been hammered home with the decision of the Mainzeal case from the Supreme Court in late August.

READ MOREPolyamorous Relationships

August 14, 2023

In a split decision, the Supreme Court recently confirmed by 3:2 that polyamorous relationships (that is, relationships between three or more people) can be subdivided into two or more qualifying relationships, to which the provisions of the Property (Relationships) Act 1976 (which applies to relationships between two people) can apply.

READ MORERefusing an Inheritance

August 14, 2023

What is the trustee of an estate supposed to do when a beneficiary will not accept their inheritance? This was the question faced by Mr Holland, executor and trustee of the estates of Margaret Glue and her husband, Ian Glue. Margaret died in 2005, leaving a life interest in her estate to her husband Ian, and her remaining estate to her two sons. Ian died in 2009, also leaving his estate equally to his two sons, David and John.

READ MOREEmissions Trading Scheme

August 4, 2023

The Emissions Trading Scheme (ETS) is the primary regime used by the government to achieve its long-term commitment to reduce New Zealand’s greenhouse gas emissions so that our international obligations are met.

READ MOREFreshwater Farm Plans

August 4, 2023

Freshwater farm plans are part of the Essential Freshwater package introduced in 2020. Its purpose is to: Stop further degradation of New Zealand’s freshwater resources and improve water quality, reverse past damage, and bring New Zealand’s freshwater resources, waterways and ecosystems to a healthy state within a generation.

READ MOREAdvance Directives

July 25, 2023

Healthcare choices can influence the quality of our lives. An advance directive can provide direction on the care you consent to, and do not consent to, when you are incapable of expressing your wishes.

READ MORELand Covenants

July 25, 2023

With all the property development over the last 20 years or so, land covenants have become commonplace in new build residential developments.

READ MOREOwning a Heritage Building

July 3, 2023

Owning a piece of New Zealand’s history may be a dream come true for some property owners, but it could be a nightmare for others. Whether ownership of a heritage building is a boon or a burden to you will depend on how your plans fit within the rules and whether you make the most of incentives available to heritage building owners. In this article, we outline some things you need to think about when owning or buying a heritage building.

READ MOREBusiness Continuity Planning

May 23, 2023

Once reserved for large businesses with a high degree of public dependency, such as banking, hospitals or utility companies, business continuity and disaster recovery plans have become increasingly important for businesses of all sizes. Severe weather events such as Cyclone Gabrielle have increased the importance of planning for the unexpected.

READ MOREKāinga Ora First Home Partner Scheme

July 3, 2023

In the Winter 2022 edition of Property Speaking we discussed what to consider when co-owning a property with friends or family. Another co-ownership option to consider is the Kāinga Ora First Home Partner scheme (FHP).

READ MOREBudget 2023

May 23, 2023

With the country expecting a no-frills Budget to match the Hipkins’ government’s bread-and-butter focus on issues for 2023, this year’s Budget had few surprises.

READ MOREHaving a cyber resilient business

April 3, 2023

It’s hard to ignore the headlines; the past few years have brought floods, plagues and an unprecedented rise in cyber-attacks. New Zealand businesses have taken the brunt of these events. Some have been pushed to breaking point.

READ MOREKeeping your employees during the ‘big quit’

April 3, 2023

Since 2021 and the lessening of the effects of the Covid pandemic, many countries have experienced an increase in staff turnover and lost productivity. This is informally referred to as ‘the great resignation’, ‘the big quit’, ‘brain drain’ and ‘quiet quitting’.

READ MORESubdivision Consents

March 24, 2023

In the Autumn 2022 edition of Property Speaking we discussed different types of resource consents. Since then, the government has released a new National Policy Statement for Highly Productive Land (NPS-HPL), which you can read here. The purpose of the NPS-HPL is to ensure that highly productive land is protected for use in land-based primary production, both now and for future generations. Councils are now required to consider the need to preserve highly productive land when determining any application…

READ MOREStorm Damage to Properties

March 24, 2023

With historic amounts of rain and flooding in many regions, this year has so far been challenging for many communities in the North Island. It is anticipated that these extreme weather events are likely to become more frequent in the future. Many properties have been damaged by flooding, landslides and silt. Some of these may be under sales agreements or leased under residential tenancy agreements. We give some advice on what landlords, tenants and buyers (who have not yet settled) can do.

READ MOREWho are the "children of the settlors"?

February 28, 2023

In the recent case of Re Merona Trustees Ltd , the High Court was asked to determine who the beneficiaries of a trust were as it was not clear who was intended by the phrase the ‘children of the settlors’ that was in the trust deed.

READ MOREWho really wants to be a Trustee?

February 28, 2023

Are you a trustee of a family trust, or considering becoming one? If so, you need to be familiar with the obligations you are taking on when agreeing to act as a trustee. You should also have a clear understanding of the risks that you are exposed to when you agree to act as a trustee.

READ MOREWhat is PPSR?

February 27, 2023

Anyone who has been in business, even for a short time, will have encountered the PPSR (Personal Property Securities Register). The PPSR is a searchable online register that records if a third party has a financial interest in the assets of individuals or entities.

READ MORELetter of Intent

February 27, 2023

A letter of intent, also known as a heads of agreement, is often used by parties before entering into a formal contract. While such a letter can be a useful tool to maintain momentum during a commercial transaction, the document itself has been the centre of many disputes over the years.

READ MOREProtecting Productive Land

December 12, 2022

Following the Our Land 2018 joint report from the Ministry for the Environment and Stats NZ, as well as a certain amount of political pressure, the government gazetted the National Policy Statement for Highly Productive Land (NPS-HPL) on 19 September 2022.

READ MORETrusts and Succession

December 12, 2022

In a previous edition of Rural eSpeaking, we covered certain aspects of the changes to trust law brought about by the Trusts Act 2019, particularly in relation to succession. That article focused primarily on the duties imposed by the Act on trustees to provide information to beneficiaries and some of the implications of that.

READ MOREPostscript

November 23, 2022

The new Fair Pay Agreements Act 2022 worked its way quickly through the House and comes into effect on 1 December 2022. The government’s objective is to provide a framework for collective bargaining of pay agreements. It stated that the legislation will improve employment conditions by enabling employers and employees to bargain collectively (by occupation, for example), rather than on an individual basis.

READ MOREAttorney vs Executor: What is the Difference?

November 23, 2022

It can sometimes be confusing when we talk about an attorney (for an Enduring Power of Attorney – EPA) and an executor who is appointed in your will and who looks after your estate when you die. The difference, as outlined below, is literally a matter of life and death.

READ MOREShared Parenting

November 23, 2022

Deciding to move to a new location can be exciting and bring a sense of renewal, particularly after a long cold winter and enduring these Covid years. However, if you are separated with children, what happens to ongoing parenting arrangements in these situations? Can you move with your children without agreement from the other parent?

READ MOREGreenwashing

November 23, 2022

The Sustainable Business Council ‘Better Futures 2022’ report[1] surveyed New Zealanders and identified that more than 43% of Kiwis are committed to living a sustainable lifestyle; this is a continuation of an upward trend over the last three years. Given the public’s motivation to be more sustainable than ever, businesses are honing their marketing strategies towards environmental sustainability.

READ MOREInsta # Dismissal?

November 23, 2022

Employers, disrepute and social media. Whether we like it or not, social media affects almost every aspect of our daily lives, including employment relationships. How can employees’ ‘private’ social media posts bring an employer’s business into disrepute and lead to an employee’s dismissal? Shouldn’t employees have privacy out of work? On the other hand, if a post adversely affects an employer, shouldn’t they be able to act?

READ MORETeam Building Event

November 4, 2022

On 15 October staff and family teamed up to create the “Kaimai Killers” team in the annual Tauranga 10 Up Dragonboat Regatta – Corporate Challenge.

READ MOREHybrid Working- Now an Option for Many Employees

September 13, 2022

The Covid pandemic has reshaped the way New Zealanders work. Southern Cross Health Insurance conducted a nationwide survey for its Workplace Wellness Report 2021 and found that since the Covid outbreak in 2020, 34% of businesses surveyed have changed their position on remote working and now offer it as an option to employees.

READ MOREContract Compliance- Fair Trading Amendment Act 2021 now in Force

September 13, 2022

If you have customer contracts, inter-business contracts or contracts valued under $250,000, the Fair Trading Amendment Act 2021, that updated the Fair Trading Act 1986, should be on your radar. The changes came into effect on 16 August 2022.

READ MOREWearing two hats in a family protection claim

August 11, 2022

In a recent case , the High Court found that a will administrator’s default in complying with a court order was so flagrant, it justified issuing an order for arrest of the administrator. How did this arise and, more importantly, how could it have been avoided? The will administrator was wearing two hats – one hat as a will administrator and the second hat as a beneficiary.

READ MORETrusts Act 2019 also affects executors and administrators of wills

August 11, 2022

When the Trusts Act 2019 came into force on 30 January 2021 the changes it brought were well publicised. However, not everyone is aware that the some of the provisions in this legislation also apply to wills and the administration of estates by executors. We outline executors’ mandatory and default duties as well as briefly discussing some interpretations of the latter.

READ MORECrown Pastoral Land reform Act 2022

July 29, 2022

In the Autumn 2019 (No 29) issue of Rural eSpeaking, we reported that the Land Information Minister had announced that tenure review of Crown pastoral land under the Crown Pastoral Land Act 1998 (CPLA) would end. On 17 May 2022, the Crown Pastoral Land Reform Act 2022 (CPLRA) became law. In this article, we outline what is included in the new legislation, what will continue to be dealt with under the old Act, and how the Crown proposes managing this land.

READ MOREHe Waka Eke Noa- Follow up

July 29, 2022

In the Autumn 2022 issue of Rural eSpeaking we wrote that, following a period of public consultation, the He Waka Eke Noa (HWEN) Partnership was about to provide its recommendations to the government on how best to equip farmers to measure, manage and reduce on-farm agricultural greenhouse emissions.

READ MOREProposed Income Insurance Schemes

May 25, 2022

Every year, more than 100,000 workers in New Zealand are laid off or lose their jobs through no fault of their own. In February, the government proposed a new compulsory insurance scheme for all employees. This would provide most Kiwis with 80% of their regular salary for a minimum of seven months if they lose work through no fault of their own (including a health condition or redundancy).

READ MORE2022 Budget - Commentary on the Minister's Main Points

May 25, 2022

The Minister of Finance, the Hon Grant Robertson, presented the government’s Wellbeing Budget to the House on Thursday, 19 May. With inflation running at a 30-year high at 6.9%, and similar levels of inflation with most of our trading partners, rising interest rates, the stock market in the doldrums, the knock-on effects of the Ukrainian war and the continuing situation with Covid, the government is walking an economic tightrope.

READ MOREForestry Update

May 13, 2022

Forestry is attracting a great deal of interest and opportunity right now. This rapidly growing area faces challenges in terms of public opinion, regulation and general understanding. With all that is going on, where does this leave the agricultural sector in terms of sequestering carbon and the Emissions Trading Scheme (ETS)? We update you on some current issues.

READ MOREHe Waka Eke Noa

May 13, 2022

He Waka Eke Noa (HWEN) is a partnership established to reduce the emissions generated by the primary sector. It works to equip farmers to measure, manage and reduce on-farm agriculture greenhouse emissions and to provide sustainable farming practices for future generations.

READ MORENot sure of your Boundary?

March 24, 2022

All property owners, whether commercial or residential, must ensure that any structure on their property is located within its legal boundaries. These boundaries cannot be moved without the property’s title also being changed. Sometimes, however, the legal boundaries do not match up with structures (such as a fence or a building) on that property. What happens when the title does not match what is literally ‘on the ground’?

READ MOREResource Consents

March 24, 2022

The Resource Management Act 1991 places restrictions on how your land can be used; this is done by the issuing of consents. Their purpose is to limit any adverse effects that your intended use of your property may cause to neighbours’ properties or the environment. If you are a property owner, or you lease premises to operate your business, we explain below the various types of consent that you may come across from time to time.

READ MORECaring for Kiwis who cannot make decisions for themselves

February 15, 2022

In the Spring 2021 edition of Trust eSpeaking, we looked at whether someone in New Zealand could end up in a similar situation to American entertainer Britney Spears. Britney was under a conservatorship (or guardianship) arrangement that was established against her wishes.

READ MOREGift or Loan?

February 15, 2022

The trusty Kiwi “She’ll be right” approach is often manifested in a reluctance to formally document intra-family lending arrangements. Catch cries of “I trust the kids to sort things out between themselves after I’m gone” and “My new partner says she will never make a claim and I believe her” are common, but all too often lead to disputes down the track. In this article, we look at three different scenarios that are based on Maddy’s story.

READ MORE'Nuisance' Is still relevant in court

December 16, 2021

Many of us are familiar with the tort of negligence — an act or omission by one party that causes loss to another party. Inherent in a negligence claim is the concept of ‘fault’. A recent case illustrates why nuisance, a tort similar to negligence except that fault is not necessary, is still relevant.

READ MORECo-owning a Property

June 20, 2022

For many, owning a property simply involves having your own name recorded on the title. There are some situations, however, where you might share property ownership with friends, family or business partners.

READ MORELand Covenants

June 20, 2022

A covenant is an instrument registered against land that governs how an owner or occupier can use their land. The land bound by the terms of the covenant is referred to as the ‘burdened land’ as that has the burden (although not all covenants are negative) of complying with the terms of the covenant.

READ MOREWater Services Act 2021

December 16, 2021

Water has been very much in the news lately, particularly with the government’s proposed Three Waters Reform Programme. The Three Waters Reform generally deals with the transfer of water infrastructure (drinking water, wastewater and stormwater) to four new water service delivery entities.

READ MORELockdown rent relief – are there remedies?

November 22, 2021

For many of us the recent lockdown brought a sense of déjà vu. Once again, a number of us were back juggling Zoom calls while supervising school work from the confines of our own homes. The landlords and tenants amongst us were again grappling with the issue of how the lockdown affects lease obligations.

READ MOREDefining a de facto relationship

November 22, 2021

You may have heard that ‘Marriage is betting someone half your stuff that you’ll love them forever’. But what happens about the ‘stuff’ you own before you formally say “I do”? The law providing equal sharing of relationship property automatically begins after three years in a de facto relationship. However, what a de facto relationship looks like, and when it starts, isn’t always obvious and is often the subject of a dispute.

READ MORECaveats

October 29, 2021

The Latin word ‘caveat’ literally translates to ‘let him beware’. In a legal sense, caveats are generally used to protect the proprietary rights of the person registering the caveat by stopping the registered owner of the property from transferring, mortgaging or otherwise dealing with the property.

READ MOREDisputes in Contracts

October 29, 2021

Building your own home or doing renovations can be a way to get exactly what you want in your residential property. Even with the best preparation and planning, however, there are things that can go wrong in a build: the work may not be completed in the agreed timeframe, the quality may be poor or there may be surprise costs. One current common issue is unexpected delays or costs due to Covid-related supply disruptions. If you find yourself in one of these situations, there are a few things to keep…

READ MORELease vs Licence

October 11, 2021

Choosing the premises from which to operate your business can be daunting; it is essential that you know you are entering into the right type of agreement to suit your intentions. Leases and licences are common contractual arrangements. Although both are similar, there are crucial differences between them which can have significant implications for anyone who owns or occupies commercial premises. Knowing their differences, and when to use each, will help prevent any confusion, conflict or loss that…

READ MOREBonding Agreements

October 11, 2021

Bonding agreements can be an incredibly useful tool for ensuring employers can recoup costs incurred for training staff. Used improperly however, bonding agreements may be unenforceable and – in some circumstances – be a clear breach of the Wages Protection Act 1983 (WPA). We look at two of the most common issues with bonding agreements as well as what should be considered for enforceable agreements.

READ MOREThe Wellbeing Budget 2019

June 10, 2019

As expected the government’s The Wellbeing Budget, presented by the Minister of Finance, the Hon Grant Robertson, on 30 May focussed very much on mental health and child wellbeing.

READ MOREPPSR Lease Losses

June 10, 2019

When the Personal Property Securities Register (the PPSR) was established in 1999, most businesses were quick to catch on that it was a good idea to register security over goods that were sold under a line of credit. What wasn’t so easily recognised is that the register was designed to also capture leases of goods that are indefinite or extend past one year.

READ MOREInsurance & Financial Services Ombudsman

April 10, 2019

The Insurance & Financial Services Ombudsman office (IFSO) was established in 1995 to help consumers who were in dispute with their insurers or financial services providers. The IFSO1 is a free, independent entity to which you can lodge a complaint regarding the conduct and decisions of insurance and financial services providers, once you have exhausted that provider’s internal complaints procedures.

READ MOREAccessing the Assets of a Trust

February 26, 2019

When a marriage, civil union or de facto relationship breaks down, the couple will usually divide their property according to the Property (Relationships) Act 1976 (the PRA). However, these two people often hold property in a trust rather than personally.

READ MORENo Enduring Power of Attorney?

February 26, 2019

Most people are now aware of the importance of having an enduring power of attorney (EPA). If you are unable to make decisions for yourself at any stage (either temporarily or longer term) it is important there is someone in place to act on your behalf. What happens to you, and your family situation, if you have no EPA?

READ MOREDo I Still Need a Trust?

January 21, 2019

If you have a family trust set up a number of years ago, it’s good practice to review it to ensure it is still ‘fit for purpose’. Leading on from that is the question that is often asked of us, “Should I bring my trust to an end?”

READ MOREHow do I Bring My Trust To an End?

January 21, 2019

It has been estimated that there are between 300,000-500,000 trusts in this country. Trusts have been established for many different reasons, including estate planning, creditor protection, to ensure access to rest home subsidies, tax benefits or for protection from relationship property claims.

READ MOREWhat Happens When Your Employee Wants to Retract Their Resignation?

January 21, 2019

We all know that people can sometimes say things in the heat of the moment which, on reflection, they didn’t really mean. What happens when your employee quits suddenly, perhaps by storming out of your workplace as a result of a disagreement? As an employer, can you take this as a resignation? What happens if your employee has a change of heart and wants to return to work?

READ MOREReceivership of Construction Companies

January 21, 2019

In light of Ebert Construction’s recent receivership, not taking protective measures opens subcontractors up to recovery and enforcement issues. If you are a subcontractor, you should think about how to prevent your tools and equipment (including cranes and scaffolding) from being seized and sold by a receiver, and to ensure you have the best chance of getting paid.

READ MOREChanges Affecting Every Buyer of Residential Land

January 21, 2019

Overseas Investment Amendment Act 2018 is now in force. The implication for you is that when you next buy residential property, there will be another layer of compliance to be completed before your property purchase goes through.

READ MOREBuying a Cross Lease Property

January 21, 2019

New Zealanders love to talk about property. There are a multitude of topics relating to property that Kiwis have an intimate knowledge and understanding about which form the topic of water cooler and dinner conversation. The cross lease is just one of those many topics of conversation.

READ MOREAgri-Tourism and Food

January 21, 2019

Agri-tourism and food are growing sectors in New Zealand. We have farm tourism where tourists are shown working farms with activities such as sheep dog and shearing exhibitions. Artisan producers are growing their own products and then processing them into, say, cheese, and free-range pigs are becoming salami, bacon and ham.

READ MOREWandering Stock

January 21, 2019

One of the perennial problems that farmers face is that of stock wandering or stock getting out and interfering with, or causing damage to, neighbouring properties. Generally speaking, the issue of having a small number of stock grazing on your land for a short time until they are put back in the neighbour’s property may not be too great a concern.

READ MORENew Website for Kaimai Law Bethlehem

January 23, 2019

Kaimai Law Bethlehem are starting off 2019 with a brand new website. The new design features photos that reflect our love of our local landscapes and new profiles of our staff so our clients can get to know them better. The new site also features a revamped news section that will enable us to keep our clients abreast of important legal matters in New Zealand.

Construction Industry and its Retentions Scheme

January 30, 2019

The collapse last year of Ebert Construction Limited took many in the construction industry by surprise, particularly its subcontractors who were owed retention moneys. In our Spring 2018 edition (No 50) we published an article on Ebert Construction and subcontractors which had a section on retention moneys. Since then, the High Court decision has provided some guidance on the retentions scheme under the Construction Contracts Act 2002. We explain the main aspects of that decision and how subcontractors…

READ MOREPotpourri of Employment Law Changes Ahead

January 30, 2019

Last year saw many changes in the employment law sphere, with the Labour-led government delivering on promises of reform in this area. Of particular significance are the changes incorporated into the Employment Relations Amendment Act 2018 that was passed late last year. These changes will affect both employers and employees. We summarise some of these below.

READ MORETenure Review Of Crown Pastoral Land To End

March 25, 2019

Tenure Review Of Crown Pastoral Land To End

READ MOREProperty Sale and Purchase

May 28, 2019

Generally speaking, GST on a property sale and purchase between two GST-registered entities results in a ‘GST neutral’ position for both the seller and the buyer. It’s essential that the sale and purchase agreement contains the correct wording, particulars and information in respect of the GST position of the parties to the agreement.

READ MORELooking For Your First Home?

May 28, 2019

The purchase of your first home may be more in reach than you think. In 2018, the government aligned the purchase price limits of existing first home buyer schemes with the newly-launched KiwiBuild programme. As a first home buyer, or an eligible ‘second-chancer’, you could use these schemes to help you into your new home, sooner.

READ MORENational Environmental Standards for Plantation Forestry

March 25, 2019

National Environmental Standards for Plantation Forestry

READ MOREAre You a Landlord or Looking to Buy a Rental Property?

May 31, 2019

From 1 July 2020, landlords will be required to provide additional details in their new or renewed tenancy agreements on how their property meets the standards

READ MOREAction Plan for Healthy Waterways

December 17, 2019

Water quality is no new issue in Aotearoa New Zealand, but it is a growing one. On 31 October 2019, the government closed submissions on the Action Plan for Healthy Waterways. The Plan has since been referred to an independent advisory panel that will consider the public’s submissions and report back to the government. The panel consists of five members with expertise in a range of areas including dairy farming, environmental law, hydrology and water management. Introducing the Plan, Environment…

READ MORERural Leases; More on COVID and access issues to land

August 12, 2020

In the Autumn edition of Rural eSpeaking we discussed the situation that COVID had caused with leases where tenants were unable to access their premises due to lockdown restrictions. Potential issues for the rural leasing sector arose from this problem, particularly given that rural leases are often in a different form to urban commercial property leases.

READ MOREOn-Farm Emissions Reduction

December 17, 2019

On 24 October 2019 the primary sector launched the ‘Primary Sector Climate Change Commitment: He Waka Eke Noa – our future in our hands to manage agricultural emissions.’ He Waka Eke Noa kicks off a collaborative five-year joint action plan between the agriculture sector, the government and iwi with the target of decreasing farming emissions and developing a farm emissions pricing scheme. If the action plan produces satisfactory results, agriculture will not be brought into the Emissions Trading…

READ MORENational Environmental Standards for Freshwater 2020

August 12, 2020

Water was the hot topic in the 2017 election campaign. This year, with an election coming up shortly, there seems to have been little talk of water (or much policy at all, so far) with COVID still taking up most of the news space, closely followed by scandals of various sorts.

READ MORELeasing Commercial Properties

November 6, 2019

Commercial leases come in varying shapes and sizes. Whether you operate a transport business and need a place to park your trucks, manufacture and sell goods from a warehouse or conduct your trade from a boutique store in the heart of the CBD, your lease agreement will be at the heart of your business. Before you sign a lease, there are a number of core issues to consider. It is important to do your homework and talk with us before you commit to anything.

READ MOREResidential Tenancies

November 6, 2019

The Residential Tenancies Amendment Act 2019 came into force on 27 August 2019. This legislation affects both landlords and tenants in a number of ways including limiting a tenant’s liability for careless damage in rental properties, and how methamphetamine (meth) contamination of rental properties is to be tested and managed. Landlords are also now required to provide a statement in the tenancy agreement about the property’s insurance.

READ MOREEmissions Trading Scheme

July 24, 2019

New Zealand’s Emissions Trading Scheme (ETS) was established by the Climate Change Response Act 2002. The ETS was created as the vehicle for New Zealand to meet its obligations for the reduction of greenhouse gas (GHG) emissions under the Kyoto Protocol. The purpose of the ETS is to achieve a reduction in GHG emissions through emissions trading. Emissions trading is the exchange of carbon credits between those parties with surplus credits and those who are required to contribute credits as compensation…

READ MOREPeople and the right information are vital for effective governance

July 24, 2019

The damage from governance failure can be profound, and can attract significant unwelcome media and public scrutiny. Focusing on the learnings from these cases is how we can get some real benefit and continuous improvement in corporate governance.

READ MORECommercial Leases Post - COVID

June 25, 2020

Clause 27.5 and inability to access premises: In the past three months, most landlords and tenants would have become more familiar with the details of their lease. In particular, most will be looking at how clause 27.5 of the Auckland District Law Society (ADLS) lease applies to the government-imposed lockdown that we have all experienced as a result of COVID-19.

READ MOREResidential Tenancies Post- COVID

June 25, 2020

Due to the COVID lockdown and the ensuing impact on the country’s economy, the government has made temporary changes to the Residential Tenancies Act 1986. These changes restrict a landlord’s ability to increase the rent or to end residential tenancies. If you are a landlord, you should read on to ensure you are not inadvertently breaching this temporary law change.

READ MORECOVID Relief Roundup

September 17, 2020

Since the pandemic arrived on our shores, the government has made available multiple types of financial relief; more than one may be available to your business. Although applications under the popular Wage Subsidy Scheme ended on 1 September 2020, other options are still available for support if you need it.

READ MOREOIO Temporary Emergency Notification Requirement

September 17, 2020

It seems as though the Overseas Investment Office (OIO) has been under constant evolution over the last two years. In June, the OIO enacted a change that now requires all overseas purchasers of New Zealand business assets to submit a notification to the OIO before the transaction takes place — regardless of the asset value. This submission will allow the OIO to monitor and prevent New Zealand asset ownership being unnecessarily diluted due to stressed sales caused by unprecedented economic pressures…

READ MORE2021 Rural Leases

May 6, 2021

Leasing of farms, orchards and cropping land is becoming more common. It is a good way for farming operations to expand without capital commitments involved in buying land. For landowners, it can be a useful way to retain ownership of the capital but give away the day-to-day farming operations, either through a desire to semi-retire or to hold the farming asset for a period while family or continued ownership issues are resolved.

READ MOREBuying off the plans

July 9, 2021

It’s no secret that the housing market in New Zealand is incredibly competitive at the moment. Already on a trajectory pre-Covid, demand has shot up since New Zealand came out of lockdown. Many people are choosing to ‘nest’ rather than spend on overseas holidays and thousands of expats are returning home earlier than planned.

READ MORE2021 Trusts

May 6, 2021

Trusts have long been the preferred vehicle for farm ownership. Historically, holding a property through a trust meant that ownership did not change on the death of the farmer and, therefore, any death duties could be avoided during the generational change. There were also significant advantages in being able to allocate income amongst a group of beneficiaries according to their personal tax rates; this was particularly popular during the 1970s and 1980s when there were high marginal tax rates.

READ MOREPost-Covid Working World

July 9, 2021

Over the past 18 months, we have seen significant changes to employees’ hours of work, rates of remuneration and the expansion of flexible working arrangements as businesses have adapted to the Covid economy.

READ MOREBuying your first home using KiwiSaver funds

August 24, 2021

But you’re already the trustee of a trust. The rules around the use of KiwiSaver have evolved over recent years as banks and other financial institutions have developed their understanding of the KiwiSaver regime. KiwiSaver members may use their funds to help buy their first home; this is straightforward. What happens, however, if you want to buy your first home and you are already a trustee of a trust that owns property?

READ MOREEstate laws due for a shake-up

August 24, 2021

The laws about the administration of estates are being reviewed by the Law Commission. Much of what has been proposed so far is uncontroversial but there are some recommendations that may prove unpopular, although they are likely to be refined during the Parliamentary process.

READ MORECongratulations Tayla!

August 19, 2020

Congratulations to Tayla Yim-Loy who was Admitted to the Bar as a Solicitor and Barrister of the High Court of New Zealand on Friday 14 August 2020, at the Hamilton High Court.

READ MOREShareholdings for Employees or Family Members

February 19, 2020

Bringing a key employee or a family member into your business by offering them a shareholding can be a powerful motivator and a significant indicator of how much you value their contributions to your success. However, the process should be done carefully with a robust shareholders’ agreement and company constitution, as there are many facets of the company-shareholder relationship that must be agreed upon to ensure a harmonious future between yourself and the new shareholders.

READ MORERestructuring your business

February 19, 2020

New year, new you – new business structure? Restructuring is common in the new year when business owners feel refreshed and ready to take on the next challenge. The process however, is often shrouded in uncertainty (and stress) for employees. Following the correct procedure for a restructure will allow your employees time to feel heard and to ensure decisions are made in good faith. They need to know your plans so they can ask the right questions and get the required support during a restructuring…

READ MOREEmission Control

July 1, 2020

What the Zero Carbon Act means for business One of the most significant pieces of new legislation introduced last year was the Climate Change Response (Zero Carbon) Amendment Act 2019, more commonly referred to as the ‘Zero Carbon Act’.

READ MORECharities in New Zealand

July 1, 2020

Charities play an important role in our society to help the disadvantaged, support specific causes or to advance knowledge. In New Zealand we have more than 27,000 registered charities, with 230,000+ volunteers and 180,000 paid staff1. Many of these charities are structured as trusts which can be incorporated and run as a trust board by the trustees.

READ MORESuccession and Trust law changes

February 19, 2021

A significant change to the succession laws relating to Māori land came into force on 6 February 2021 (Waitangi Day). Te Puni Kōkiri states that the amendments to Te Ture Whenua Māori Act 1993 are intended to better support whānau to succeed to their land by:

READ MORETrustees' Expenses

February 19, 2021

Should be reimbursed, but no need for extravagance. When trustees incur expenses, they are not expected to be out of pocket in carrying out their responsibilities. Trustees are entitled to use trust money or to get a refund from the trust fund if they incur expenses in carrying out their duties. Trustees’ expenses, however, must be fair and reasonable. A recent case shows why it is also important to be sure that you can trust your trustee not to take advantage of the right to claim expenses.

READ MORESubdivisions

August 5, 2019

Subdivisions are more common than you think. A subdivision can range from the carving up of hundreds of acres of rural land for housing, developing land in a prime commercial area, selling half your quarter-acre section or simply wanting to extend your boundary a few metres. Whatever the scale of your subdivision, there is a common thread of stages to be ticked off – we explain below.

READ MOREThe Secret Lives of Tenants

August 5, 2019

Following publicity in 2018 that some property managers were using the ‘KFC test’ to vet prospective tenants, landlords’ protection of their tenants’ privacy has come under scrutiny by the Privacy Commissioner. Any unlawful intrusion into your tenants’ private lives can be a costly mistake. If you are a landlord, it is timely to ask yourself, “How can I best protect my property without risking a privacy breach?”

READ MOREChanges to the Building Act 2004

October 20, 2020

Changes to the Building Act 2004 came into force on 31 August 2020. The changes vary the circumstances under which you are required to obtain a building consent.

READ MOREUnderstanding Your Property Title

October 20, 2020

Before you buy a property it is important that you understand exactly what you are purchasing. Your property title records (or should record) all of the interests that affect your title. That way, you are fully informed about any rights or obligations you may have – before you buy.

READ MORELegal Documents Signed during Lockdown

August 21, 2020

Best to sign again after lockdown to avoid later complications. During the COVID lockdown, special rules applied to the signing of some legal documents. Obviously it was, and is, not possible to have your signature witnessed by someone outside your bubble in Levels 3 and 4. So the law allowed signing over audio-visual link (AVL) and other similar arrangements. While these documents will remain valid in the future, it may be wise to have wills and enduring powers of attorney (EPAs) signed out of…

READ MORESuccession Law in New Zealand

February 24, 2020

In late 2019 the Law Commission reported back to the government on its review of the Property (Relationships) Act 1976 (PRA). Discussion on Part 8 of the PRA that deals with the division of relationship property on the death of a spouse or partner was specifically excluded from the scope of that review. Acknowledging the issues that could arise by not addressing the division of property when a spouse/partner dies, in December last year the government asked the Law Commission to review the law of…

READ MORETrustee's Decisions

August 21, 2020

In a recent case, trustees’ decision-making came under scrutiny from the High Court. Lara Unkovich was a young teenager when her grandfather died in 2016, leaving her a share of his estate. Her share was worth around $65,000. Under his will Lara would not receive the funds until she was 21 years old. The trustees, however, had the power to make payments towards her ‘maintenance, education, advancement or benefit.’ The trustees were her aunt Margaret and a lawyer.

READ MOREEnduring Powers of Attorney

February 24, 2020

In previous articles in Trust eSpeaking, we have explained why it is important to have an enduring power of attorney (EPA) and the problems that can be created if you do not have one when the need arises. You should have two EPAs – one for property, and the other for personal care and welfare. In your EPA, you should also take care to name appropriate people as your attorneys. Ideally you should name two people to manage your property, which also includes your finances and investments.

READ MORESmooth sailing this summer

November 19, 2019

With summer fast approaching, many businesses will be hiring temporary staff to meet their needs over the busy summer months. Taking on temporary staff can throw up some tricky issues. Employers often are uncertain about what employment agreement is appropriate for temporary staff and how their holiday entitlements should be met. We explore the pros and cons of different kinds of agreements for temporary employees and provide guidance on their annual leave and holiday pay entitlements.

READ MOREEnjoy our waterways- but think water safety!

November 19, 2019

We are truly blessed to live in the Land of the Long White Cloud. This beautiful country of ours is, however, also the land of water. Wherever you are, you are never far from water. We are world-famous for our stunning waterways – our lakes, rivers and beaches. But, it‘s also important to always remember that water can be dangerous and unpredictable. Whenever you are near a waterway – going for a swim, collecting seafood, or paddling or boating – it is vital that you think about water safety. Swimming…

READ MOREInvestment in Farming

December 18, 2020

With the current low interest rate regime looking set to continue for some time, investors are increasingly looking at ways to generate a reasonable income either for their retirement or for other forms of saving. Recently, commercial property syndicates have come back into fashion. Their popularity is based on the return that they are able to provide to investors, notwithstanding the risks inherent in that sort of investment.

READ MOREThe Finite Supply of Water

December 18, 2020

Water is an absolute necessity for any type of farming or horticultural activity. Historically viewed as an infinite and expendable resource, water is now seen as having a finite supply and must be dealt with as a commodity. The right to access water from a source, such as a spring or well, and the right to use that water are different, but related, issues.

READ MOREWellbeing Budget 2021: Key Points

May 26, 2021

A better than expected economic recovery after the scourges of Covid has enabled the government to propose significant investment in health and welfare, housing (particularly for Māori), infrastructure to rebuild from the impact of the pandemic and to continue to make this country safe from the virus.

READ MORETo Jab or not to Jab?

May 26, 2021

While many Kiwis are queuing up and eagerly awaiting their Covid vaccinations, not everyone is willing to take ‘the jab’. Recent headlines of sacked border staff who refused their Covid vaccinations have highlighted the difficulty many employers will face in deciding if their staff can reasonably be required to be vaccinated. Dismissing one of your employees on the basis of vaccination status is not as straightforward as it may seem and, in most cases, will be grounds for a personal grievance.

READ MORETrusts Act 2019

October 9, 2019

The new Trusts Act 2019 will come into effect on 30 January 2021. Much of the Act updates or restates lawthat exists already, either in statute or in case law. There are, however, a number of changes about which trustees and settlors should be aware.The Act contains ‘mandatory’ and ‘default’ duties for trustees.

READ MOREGrandparent Wills

October 9, 2019

Grandparents often want to give some financial assistance to their grandchildren and great-grandchildren. There can be a number of good reasons for making specific provision for grandchildren in your will or through a family trust. The traditional will-drafting practice is for parents to provide for each other and then when both of them have died, they provide for their children, on the assumption that their children will then in turn acquire assets and provide for grandchildren and great-grandchildren.

READ MORESignificant Natural Areas

July 30, 2021

The identification of ‘Significant Natural Areas’ has been in the news lately. How are these areas defined and what are the implications for rural landowners?

READ MOREBuying or Leasing Māori Land

July 30, 2021

There are significant amounts of Māori land in New Zealand in productive rural areas. Much of this land is farmed by way of lease, sometimes in conjunction with adjoining general freehold land. Sometimes these ’joint’ farms have been farmed in this way for generations. For Maori land to be leased or sold, however, specific rules apply. The Te Ture Whenua Maori Act 1993 governs the ‘alienation’ of Māori land.

READ MOREDirectorships Mean Significant Obligations

November 23, 2020

Hefty consequences for getting it wrong when company was in financial distress. In September 2020, the Supreme Court released its keenly anticipated decision in the Debut Homes case . This decision illustrates the risks for directors where a company is experiencing irrecoverable financial distress.

READ MOREHoliday Houses

November 23, 2020

With New Zealand’s borders closed and overseas travel restricted for the foreseeable future, many Kiwis will be looking to rent a holiday home for the traditional summer holiday this year. There are plenty of options on sites such as Bookabach, Holiday Houses and Airbnb as well as renting a holiday house privately. Whether you own a holiday home and are looking for some extra income, or you want to rent a place for the whānau Christmas, there are a few things to remember.

READ MORENAIT Review

August 16, 2019

The NAIT (National Animal Identification and Tracing) system was first introduced in 2012 and came into effect progressively until it was fully implemented on 29 February 2016. Any completely new system is likely to need a review after being in operation for a period of time. Within 18 months of NAIT’s final implementation date, the outbreak of Mycoplasma bovis in this country gave the regime a real test and, not surprisingly, the system was found wanting in some respects.

READ MOREOver the Fence

August 16, 2019

The law surrounding the ownership and possession of firearms has been reformed following the Christchurch mosque massacre. The Arms (Prohibited Firearms, Magazines, and Parts) Amendment Act 2019 has introduced changes to ban the ownership and possession of most semi-automatic firearms and pump-action shotguns (known as ‘prohibited firearms’), some large capacity magazines (‘prohibited magazines’), and parts (‘prohibited parts’). New offences have also been created, such as importing a prohibited…

READ MORESocial media – intellectual property owner’s friend or foe?

April 21, 2021

Treat your friend as if he might become an enemy (Publilius Syrus, 85-43 BC) Social media is a very powerful marketing tool. If used and managed properly, platforms like Facebook, Instagram and Twitter can be a brand’s best friend.

READ MORECyber security 101 for business

April 21, 2021

You arrive at work to find that files with sensitive commercial and client information held on your computers have been hacked. This is the situation the Reserve Bank of New Zealand (RBNZ) found itself in earlier this year. In January, the RBNZ encountered a data breach of its global file-sharing application Accellion FTA. This application was once used by the RBNZ and its stakeholders to share personal and commercially-sensitive information.

READ MOREThe Wellbeing Budget 2020: Rebuilding Together

May 19, 2020

The government’s Budget, presented by the Minister of Finance the Hon Grant Robertson on 14 May has addressed, in the words of the Minister, “a 1-in-100 year health and economic challenge” as it moves to rebuild the economy post-COVID-19.

READ MOREGovernment's COVID-19 Wage Subsidy Scheme

May 19, 2020

Many New Zealand employers are scrambling to maintain solvency while balancing their employer obligations during the COVID-19 lockdown; thousands of businesses accepted the government’s COVID-19 12-week wage subsidy as a necessary lifeline. The subsidy was not, however, a gift. We take a closer look at employers’ obligations when accepting the wage subsidy.

READ MORERecent Property Tax Changes

June 18, 2021

In March 2021, the government announced three changes to property tax rules that are likely to affect anyone with residential property investments. The changes include extending the bright-line period from five years to 10 years, changing the main home exemption ‘test’ and removing the ability to deduct mortgage interest from rental income.

READ MOREGoing out on your own

March 31, 2020

You have decided to quit your job, and go out on your own to run your own business. Do you form a company or trade in your own name? We outline some of the pros and cons of these two options to help you make a decision.

READ MOREClarity around Fixtures and Fittings

June 18, 2021

In December 2020, a commercial landlord and their tenant found themselves in the High Court arguing about who was responsible for replacing fixtures and fittings because their lease was silent on the issue. These types of disputes around fixtures and fittings in commercial leases are quite common.

READ MORESolving relationship property issues by mediation

March 31, 2020

After separating, you could find yourself at loggerheads with your former partner or spouse on exactly how all property should be divided between you. Negotiations may be bouncing between your lawyers, with no common ground achieved. Without agreement, you could file court proceedings but learn costs would increase dramatically. As well, it could be years before a judge can give a decision on how your property will be divided. Mediation, on the other hand, could be arranged within weeks. It offers…

READ MOREAre restraint of trade clauses worth the bother?

September 12, 2019

Restraint of trade clauses are common in the sale and purchase of a business and in some employment agreements. In a business context, they offer protection to a buyer who has acquired a business and prevent the seller from directly competing against the buyer. A restraint provision in an employment context is designed to protect the employer’s business interests when key employees leave. There’s a general perception that these clauses are difficult to enforce, so why bother?

READ MOREEmploying people with a past

September 12, 2019

Employing staff is never a simple process. Finding people with the right skills and personality to fit into your team can be challenging. Today’s employers go through a rigorous process when recruiting; most believe it’s better to put time into getting the right person than to have to deal with the consequences if things don’t work out. One aspect of all staff recruitment is background checks on applicants. This is more important in some roles than others. It’s standard to ask prospective employees…

READ MORERaising Capital for your Business

February 5, 2021

The COVID pandemic has paved the way for innovation, and many New Zealanders spent 2020 investing time and money into their new or existing businesses. When raising capital to grow their business, however, many business owners find themselves limited by the size of their wallet. While interest rates are currently at an all-time low, trading banks’ lending terms are arguably the strictest in recent memory.

READ MORERent Reviews in Commercial Leases

March 17, 2021

Negotiating commercial leases can involve a significant amount of crystal ball gazing – particularly when some leases can last decades. As recent times have shown, the landscape at the start of a lease can be miles away from the situation at the end of the lease. One area where the shifting sands can bite for long-term leases is the rent figures. Without appropriate rent review clauses to adjust the rent, any landlord could find themselves with a vastly undervalued rental as the lease progresses.

READ MOREHaving a puff at work

February 5, 2021

New Zealand laws have finally caught up with vaping (also called e-cigarettes) that have, for some time, enjoyed freedom from the country’s strict tobacco regulation. Since 11 November 2020, however, all vaping products and behaviours must now be treated the same as for tobacco products and smokers. All businesses and employers should be aware of the changes to SmokeFree legislation; for retailers of any vaping-related products these changes are especially important.

READ MOREReverse Mortgages

March 17, 2021

The current combination of increasing living costs, rising house prices and low interest rates has seen more than property-seekers signing up to home loans. On the other side of the coin, some older homeowners are seeking ‘reverse mortgages’ from their lenders in order to release the growing equity in their property.

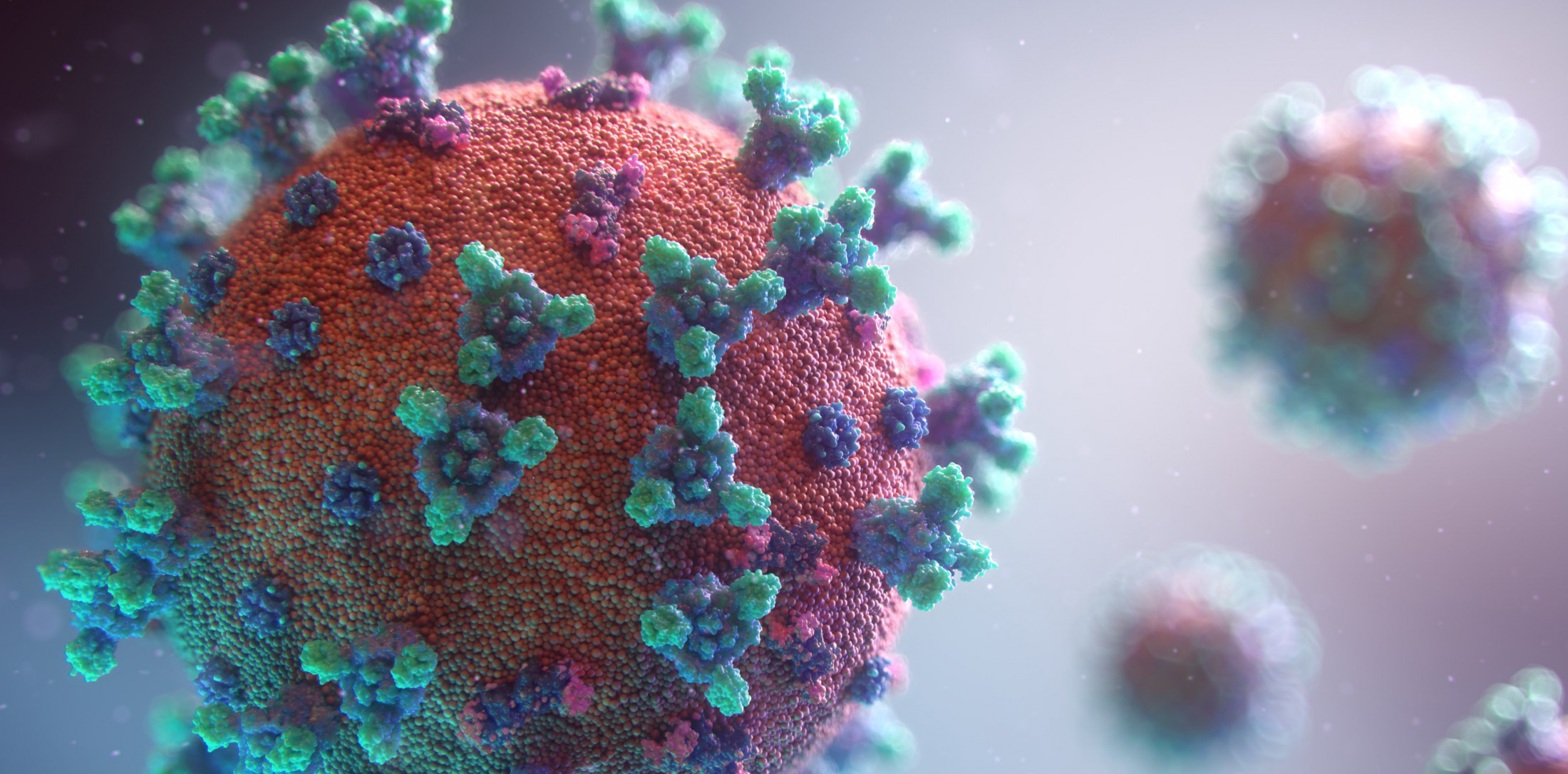

READ MORECovid-19

May 1, 2020

The COVID-19 virus that is sweeping the world will impact upon us all and pretty much everybody in the world one way or another. The repercussions will differ depending on where you live, what age you are and what you do, but it will be there nonetheless. The economic impact of the virus is uncertain but it will be significant. In New Zealand, the immediate effect was on the tourism, hospitality and retail sectors.

READ MORERural Leases

May 1, 2020

As a result of the COVID-19 Alert Level 4 situation, one of the issues that has arisen in the commercial leasing area is that of tenants being unable to access their leased buildings. These tenants are in non-essential industries and are therefore prohibited from working, other than from home. This affects commercial leases right across the spectrum from hospitality, retail, office to warehousing. Leasing is common in the rural sector, particularly in the pastoral, horticultural and cropping areas.…

READ MORERetirement Village Life

December 18, 2018

New Zealand’s ageing population has created a boom for retirement villages, with record numbers being developed. For many looking to retire or slow down, retirement village living is attractive – and it’s not hard to see why. A new apartment or cottage in a secure, well-maintained environment, offering a lock-up-and-leave lifestyle, and providing resort-like facilities such as cafes, gyms, pools, bowling greens, libraries and men’s sheds can be very appealing.

READ MOREMake Sure You Have a Will

December 18, 2018

New Zealanders need to find time to sit down and make sure they have a will. We all know this is important but how many of us don’t get around to it? Recent research by the Commission for Financial Capability has shown that only 47% of Kiwi adults have a will and the figures are worse for women, Māori and Pasifika. This survey of 2,000 New Zealanders found that only 44% of women have wills compared with 51% of men. These statistics are concerning when you consider the devastating effects that not…

READ MORE